Natacia Mata Real Estate Agent

Natacia Mata Real Estate Agent

Essential Steps to Homeownership

Navigate the home buying process with confidence.

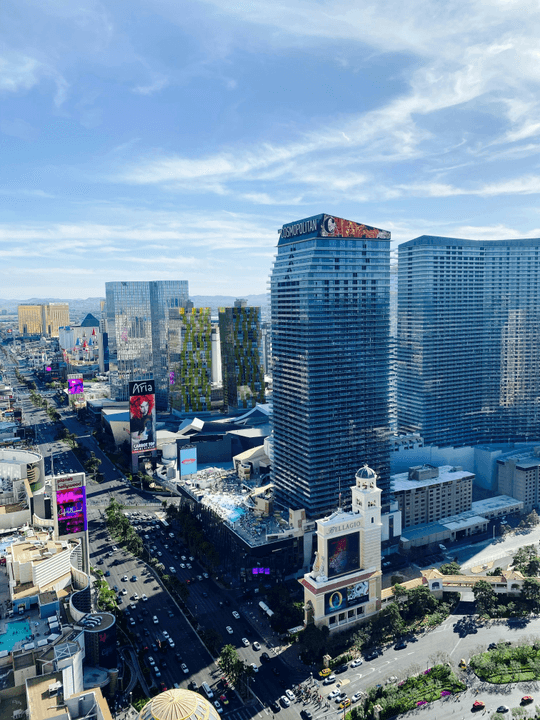

June 12, 2025June 12, 2025June 12, 2025Las Vegas Market Insights

Stay informed with the latest market trends.

Current Market Overview

Our current market overview provides a snapshot of the Las Vegas real estate landscape, highlighting recent sales data, average home prices, and inventory levels. This report is crucial for both buyers and sellers to understand the dynamics of the market. As we analyze current trends, we can offer insights into whether it's a buyer's or seller's market, enabling you to strategize your next steps effectively.Price Trends Analysis

Our price trends analysis delves into how home prices have shifted over recent months. By examining historical data and forecasting future trends, we provide valuable information that can inform your buying or selling decisions. Understanding price fluctuations can help you identify the right time to enter the market and secure your ideal property at the best price.Neighborhood Performance Reports

Explore our neighborhood performance reports to gain insights into specific areas within Las Vegas. Each report includes statistics on sales activity, average days on market, and demographic trends. This information is essential for buyers looking to invest in the right community and for sellers wanting to maximize their home's appeal based on neighborhood performance.Your Questions Answered

Find clarity in the home buying and selling process.

What is the first step in buying a home?

How long does the home buying process take?

What are closing costs?

Explore Your Financing Options

Find the best mortgage solutions for your needs.

Conventional Loans

Conventional loans are a popular financing option for home buyers, typically requiring a minimum down payment of 3% to 20%. These loans are not insured or guaranteed by the federal government, making them suitable for buyers with good credit and stable income. With various terms and competitive interest rates, conventional loans can be tailored to meet individual financial needs.FHA Loans

FHA loans are government-backed mortgages designed to help first-time home buyers and those with less-than-perfect credit. These loans require a lower down payment, often as low as 3.5%, making homeownership more accessible. FHA loans also come with more flexible qualification criteria, allowing buyers to achieve their dream of owning a home in Las Vegas.VA Loans

VA loans are a fantastic financing option for veterans and active-duty service members, offering numerous benefits such as no down payment and no private mortgage insurance (PMI) requirements. These loans are backed by the U.S. Department of Veterans Affairs, making them a secure and affordable choice for qualifying individuals looking to purchase a home.USDA Loans

USDA loans are designed to promote homeownership in rural areas and certain suburban locations. These loans offer 100% financing, meaning no down payment is required, which makes them an attractive option for eligible buyers. With favorable interest rates and flexible credit requirements, USDA loans can help you secure your dream home in less densely populated areas around Las Vegas.